Consumer AI by the Numbers with Dan Frommer // BRXND Dispatch vol. 74

You’re getting this email as a subscriber to the BRXND Dispatch, a newsletter at the intersection of marketing and AI. We’re hosting our next BRXND NYC conference on September 18, 2025 and currently looking for sponsors and speakers (including cool demos!). If you’re interested in attending, please add your name to the wait list. As space is limited, we’re prioritizing attendees from brands first. If you work at an agency, just bring a client along—please contact us if you want to arrange this.

Luke here. As part of the postscript for the BRXND LA conference, I’m going to recap Dan Frommer’s presentation, which offered a refreshing perspective on consumer AI adoption. For those of us immersed in AI developments daily, it’s easy to lose touch with how most people actually perceive this technology and where they’re putting their time and money. Dan’s research provided a valuable reality check, examining how consumers are navigating what might be the fastest technological transformation in history.

How Consumers Are Thinking About (and Using) AI

Last month in LA, Dan Frommer (DF), who runs The New Consumer—an excellent publication that looks at how and why people spend their time and money—shed light on how consumers are actually engaging with AI. His research combines proprietary survey data from over 3,000 US residents with spending analysis from sources like Earnest Analytics and Appfigures. After the show, DF was kind enough to share the slides from his deck, which he recently updated with fresh data. (I also recommend checking out his Substack.)

Below, I’ve highlighted some of the most interesting findings from his presentation. Or you can watch the full recording here if you prefer.

AI Has Already Gone Mainstream

94% of Americans have heard of AI, a higher awareness level than Doritos, TikTok, or Viagra.

More crucially, consumer spending on AI mobile apps has reached a $2B annual run rate. The top-downloaded AI apps today are general assistants and core models.

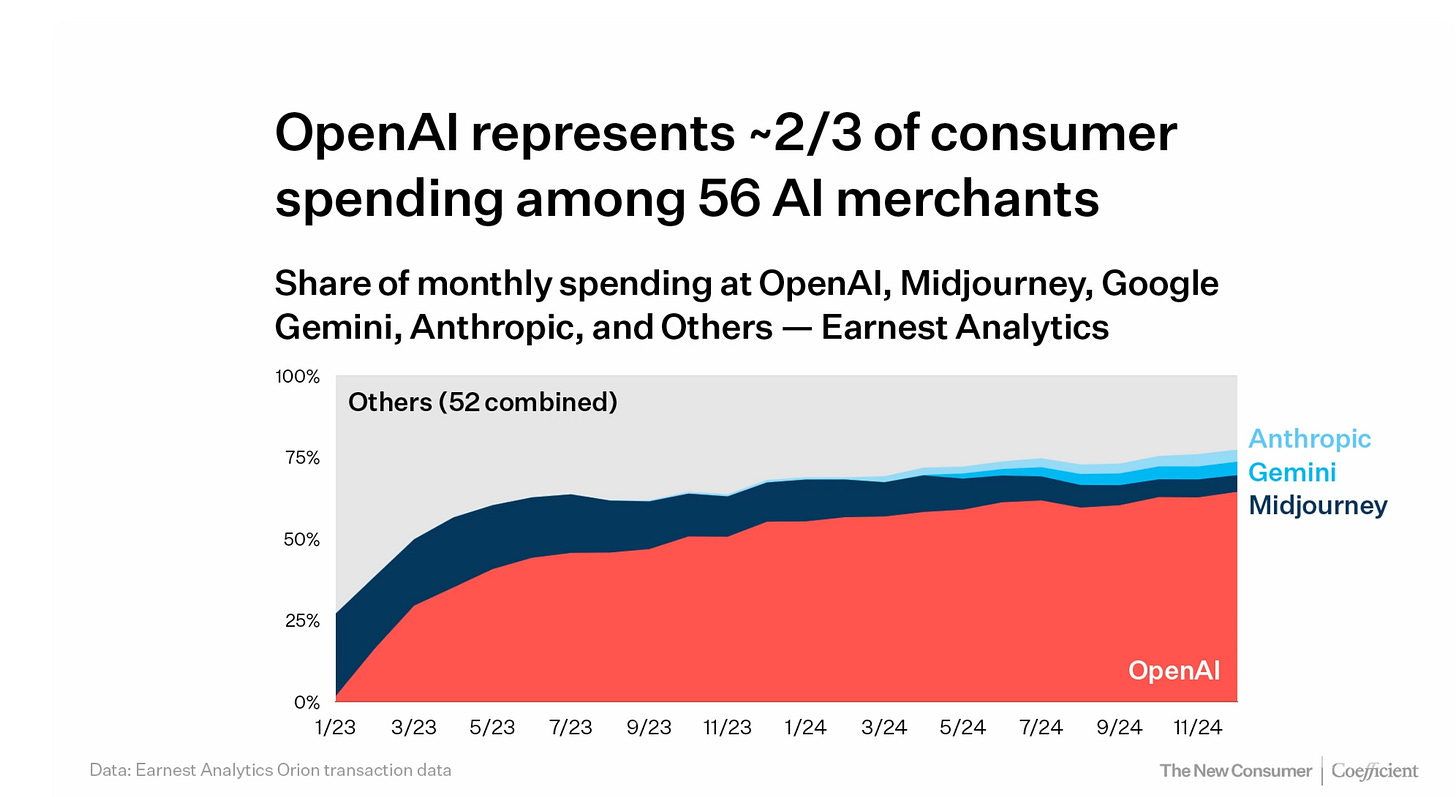

OpenAI has a clear lead among consumers, accounting for approximately two-thirds of personal AI spending, followed by Google Gemini, Claude, and Midjourney.

52 smaller AI tools combined account for only about 25% of consumer spending

ChatGPT monthly subscription revenue is approaching mid-tier streaming services like YouTube Premium, but is still only one-fifth of Spotify’s run rate.

How addicting is AI? After 1.5 years, more than half of initial subscribers are still paying for their ChatGPT subscription, which is more than Paramount+ but less than Netflix or Spotify.

How Consumers Are Using AI

Current use cases are narrow but growing. Writing, coding, and creative tasks dominate today, but according to OpenAI, consumers want more applications for personal improvement, e.g learning new skills, career development, health and fitness.

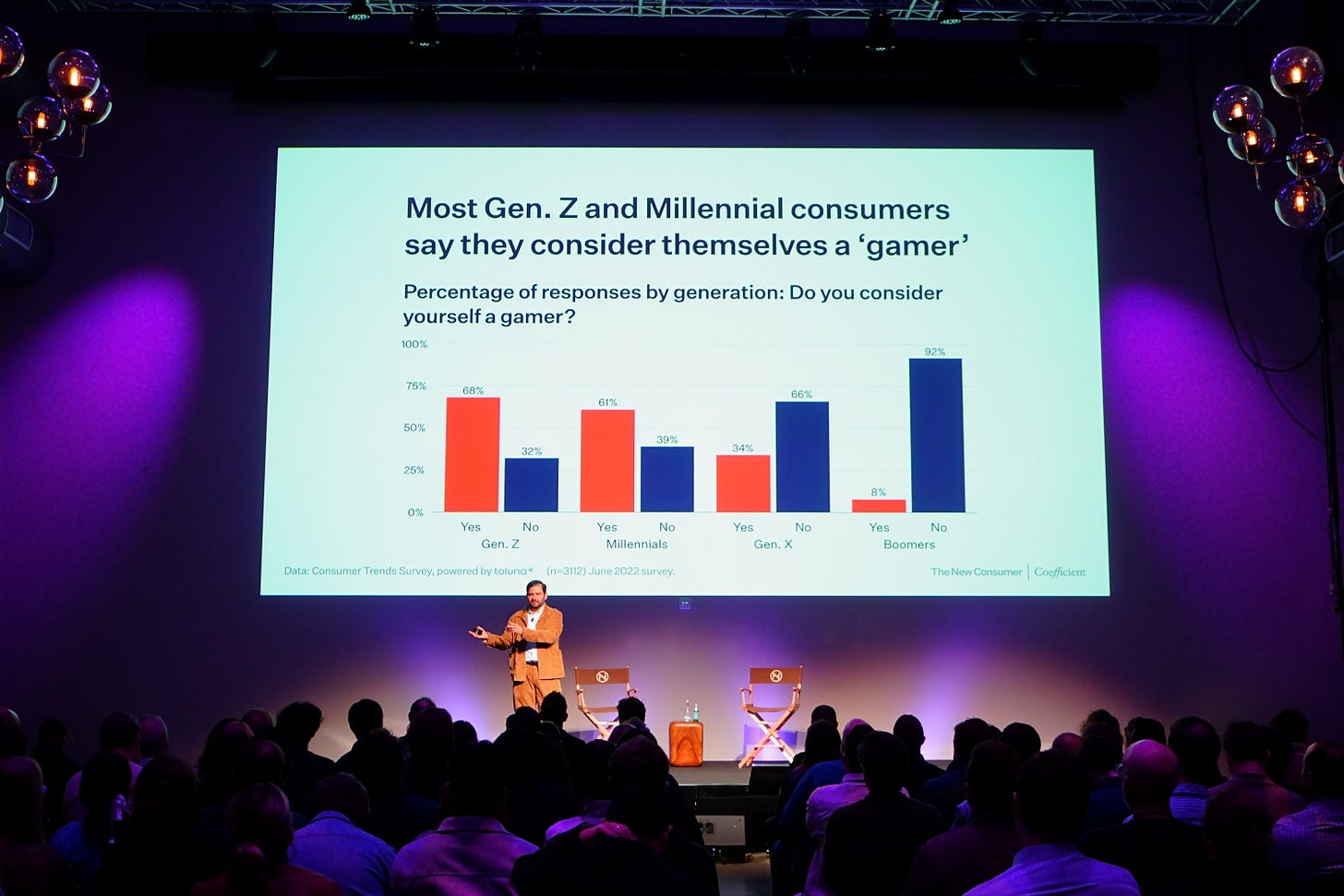

Perhaps unsurprisingly, usage shows clear generational patterns, with about half of Gen Z and Millennials reporting AI use for work. There’s also a noticeable generational divide in sentiment. Younger consumers primarily say they are “excited” about AI (40%); older consumers primarily say they are “worried” (50%).

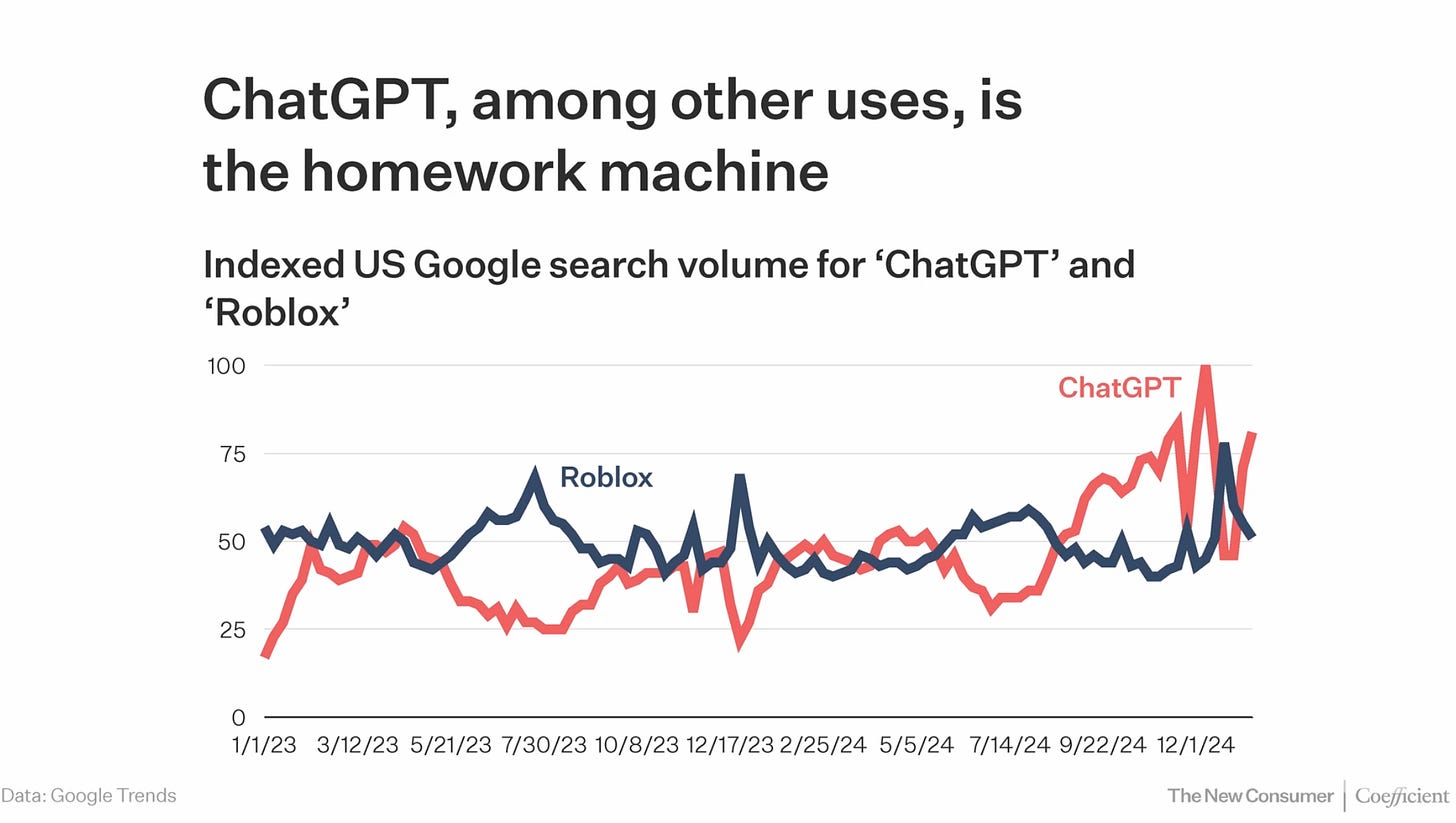

DF put it bluntly: AI tools are, among other things, “homework machines.” Case in point: Google shows a clear spike in ChatGPT search volume during school finals. About 26% of teens admit to using genAI for homework, up from 13% in 2023. Most teens say it is acceptable to use AI tools for research, but a large percentage consider it unethical to use LLMs to solve math problems or write essays.

Most young consumers have used AI for fun or entertainment, which can be an on-ramp for more serious exploration. About 40% of Gen Z and Millennial consumers believe most movies, art, music, and books will be AI-created within 20 years. Interestingly, almost the exact same percentage believe the best content in these categories will be AI-created.

DF’s data showed that while most professionals using AI at work (>50%) openly disclose this to colleagues, a significant percentage still keep their AI usage private. This suggests evolving social norms around AI use, with some workplaces more accepting than others.

Many consumers, especially younger ones, say they’re using AI services for advice.

DF’s data leads to the conclusion that consumer AI has moved from niche to mainstream with remarkable speed. The patterns we’re seeing suggest a few possible takeaways:

AI is a real consumer category now. With $2B in annual spending, mainstream awareness, and retention rates comparable to established subscription services, consumer AI adoption is still nascent, but this isn’t a speculative technology anymore.

There’s a gap between current and desired use cases. Consumers want AI to help with more advanced tasks beyond writing, editing, and coding, but the tools aren’t quite delivering yet. This represents an opportunity for apps that can bridge this gap. (DF singled out AI agents as a potential game-changer for consumers.)

Ethical considerations are evolving in real-time. The mixed attitudes toward AI in professional and educational settings highlight the complex ethical landscape surrounding these tools. This suggests that social stigma, or the lack of clear guidelines around appropriate use, may be its own barrier to adoption.

Thanks for reading. If you want to watch DF’s presentation—or any of the other talks from BRXND LA—you can stream them on our YouTube channel anytime.

If you have any questions, please be in touch. If you are interested in sponsoring, reach out, and I’ll send you the details.

Thanks for reading,

Luke